There has been a lot of action in the Australian Restaurant Industry, so we thought it was time to update our comparison of who is winning the delivery wars – Deliveroo vs Menulog vs UberEats vs DoorDash vs Dominos. We’ve conducted some research to determine who is delivering the most, what will happen over the next 2 years and what it means for your Restaurant.

Whats new in the Restaurant Delivery industry?

Menulog News

We think Menulog has had a horror 12 months. A legal campaign was created against their domain name practices and concerns have been raised about their brandjacking and adwords arbitrage, Just Eat entered merger negotiations, their first half results showed a 10% decrease in customer numbers, and Alistair Venn left the company as CEO to become COO of Safety Culture. Ben Carter has come out from Just Eat UK as the new CEO. These issues have created concerns about how long Menulog will have to become profitable and to grow, or whether it will be closed down.

Deliveroo News

Deliveroo had a tough 12 months in Australia. It looks like it has failed to increase orders. Recently, respected CEO, Levi Aron, with significant experience in the online ordering space with his work at EatNow, left the company. He has been replaced by Ed McManus who has worked in the past as head of sales operations at realestate.com.au, where he worked for REA Group’s Greg Ellis who is an advisor to Deliveroo.

Deliveroo’s Annual Results for 2018 list the company as being valued at $2 billion, ($3 billion AUD). This places them as one of the smallest companies by market cap operating in the Australian market. They are even smaller than Domino’s Pizza in Australia so questions abound about their long term viability, especially with the increased competition. They are also facing a legal challenge from one of their ex-drivers. This creates the possibility of a Foodora style exit following the chances of a bad outcome in the courts. The seriousness of the situation may have been the reason that Will Shu was out in Australia.

Uber Eats News

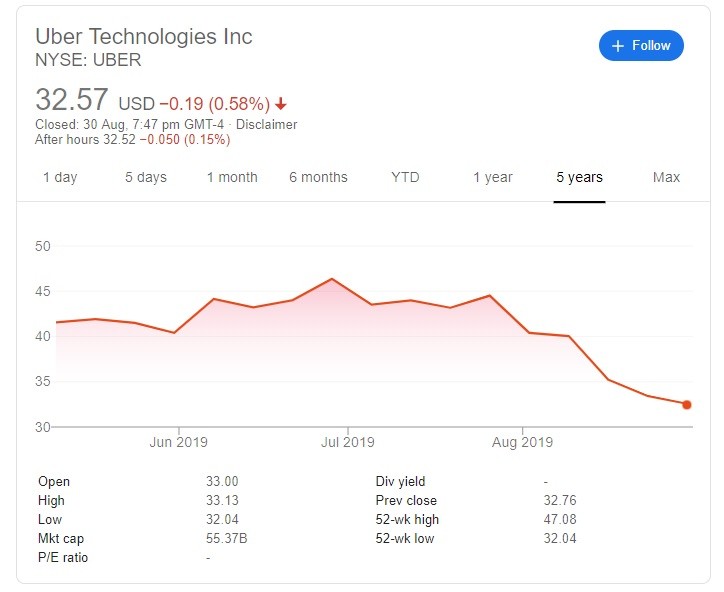

UberEats has continued to be a leader in the industry, however recent legal concerns have forced changes to their terms and conditions with Restaurants. There is also the no small issue about the losses they are suffering. UberEats parent, Uber lost 656,000,000 in Q2. This was a 125% increase. It is looking to increase fees in UberEats in an attempt to stem the losses.

DoorDash News

In a quite surprising move, DoorDash entered the Australian Market. This is quite surprising seeing that Foodora left last year. We expect that they have either done a lot of due diligence and have some sort of Secret Weapon to grow the three sided market that is Restaurant Deliveries, (riders, restaurants and diners), or it has a lot of money to burn. Deliveroo, it appears has failed to dent UberEats, so it will be interesting to see how they expect to grow their business. Either way, the market is certainly not big enough for the 4 players, and maybe not big enough for 2, so we expect 1 and probably 2 of DoorDash, Menulog and Deliveroo to have less than 18 months left in the Australian market.

Dominos News

Domino’s had a great year. In Japan they delivered a Pizza in a record 2 minutes and 38 seconds! Revenue was $1,435,400,000 across the group. Across Australia and New Zealand they sold more than 2 million pizzas and sides in one week.

Domino’s has a proven capability in food logistics and this is making a difference. They have a strong business model, not withstanding a number of issues with franchise.

Restaurant Delivery Rankings Australia 2019

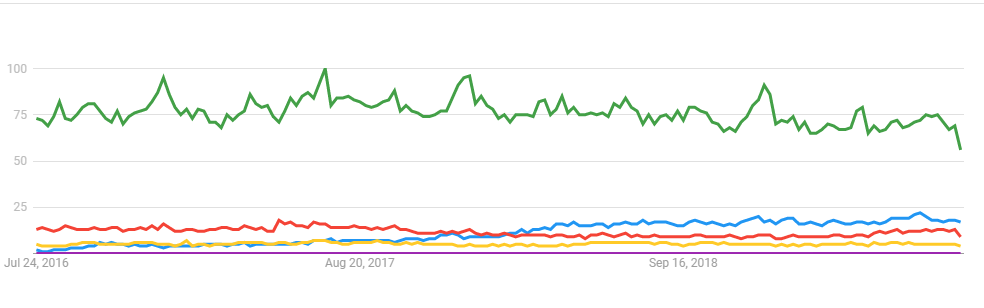

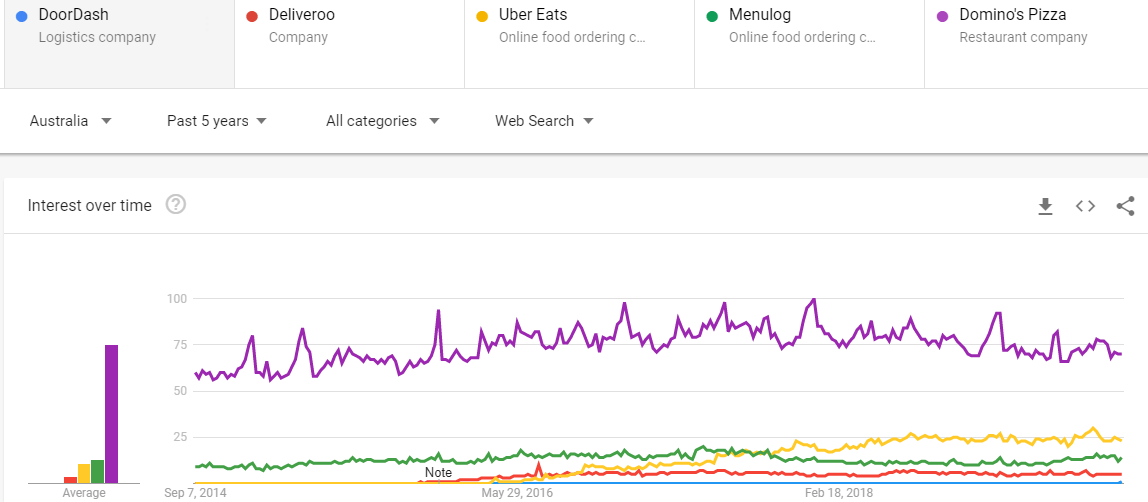

The below graph is a Google Trends graph highlighting the search interest for the last 5 years. Clearly Domino’s is well ahead of all of the other Food Delivery companies. We expect this to continue for the next 2 years.

We look at who is delivering more in Australia – Menulog vs Uber Eats vs Deliveroo vs DoorDash vs Dominos

Based on our research, discussion with Restaurants and published financial accounts we believe that Domino’s Pizza still delivers more food per week than the delivery aggregators.

- Dominos Pizza

- Uber Eats

- Deliveroo

- Menulog

- DoorDash

Dominos ships an awful lot of Pizza and they do it in a much more reliable way. All of the delivery aggregators with their ‘independent contractors’ struggle with timeliness. Uber Eats is a strong second, and there is quite a lot of room between them and Deliveroo. We believe that Deliveroo is ahead of deliveries that they conduct. Menulog was very late to the game in Australia and is struggling to make up the difference. Menulog in terms orders is ahead based on our assessment of Deliveroo, but much of that is just order taking, with the Restaurant doing the delivery’s themselves.

What about independent Restaurants?

It is incredibly difficult to determine the number of Restaurants that are currently delivery food. We expect that this is still the dominant means of getting food from Restaurant kitchens into the homes and offices of hungry customers.

Restaurant Delivery predictions for 2020

The #logout Campaign

The recent #logout campaign in India is just the start of a growing backlash that we are seeing. The fundamental question is if a Pizza Restaurant was able to do delivery for the last 30 years without having these massive price rises, couldn’t all Restaurants do it? And we think that the answer is yes. More Restaurants will look to go direct with their customers and build their own database, using their POS system or a Free OnLine Ordering system like FROLO.

Legal Risk

Deliveroo is in the midst of a court case with a contractor claiming he was paid below the award wage. The issue for aggregators globally is that this is becoming a global issue and regulators and law makers are realising that contractors are taking jobs from Restaurants who employ people to do their own deliveries. These low paid or underpaid jobs are displacing full time and part time jobs and I don’t think that it will be long term sustainable from a legal point of view.

Customer disenfranchisement

Many customers are shocked at the massive commissions that are charged by delivery aggregators, which are often as high as 35% and potentially these will rise as they attempt make their business models profitable. We are seeing a lot of Restaurants have a lot of success with ‘Order direct and save campaigns.’ Many, not all, but many customers are keen to support their local businesses, restaurants in particular and they are often prepared to pay for the privilege, either by picking up take out or a little higher price. The thing we are seeing is that often Restaurants are able to offer significant savings so it is often a Win-Win for the Restaurant and for the customer.

Talk to the M4R Team if you need help making online orders profitable and check out Secret Sauce, the World’s Number 1 Restaurant Marketing Podcast.

Franchise disenfranchisement

We believe that although much has been made of deals like delivering for KFC with Menulog, these are experiments to quantify the interest from consumers for food at home. Once proven, it would be a directors responsibility to build their own delivery capability with their franchisees. The clear reason is that if Domino’s can do it, why can’t KFC. The level of service provided with the outsourced delivery is low as it is, so service levels would probably improve in the short term and definitely over the long term as chains see the value in delivery conducted by employees rather than a random contractor. This will be a serious threat for the aggregators.

2020 Restaurant Delivery predictions

We expect Menulog and Deliveroo or DoorDash to close in Australia. The economics simply do not support this level of competition.

** The article was edited after further information from Menulog **

Is Poor SEO Killing Your Restaurant?

Too many times we see customers with websites that are costing restaurants thousands of dollars every month through poor design, poor messaging and poor SEO. If your website could be improved to bring in 200 extra visits per month and just 10% of those made a booking, and each booking was for 2.5 seats on average at $50 a seat, you would have an extra $2,500 in revenue a month. A 30% food cost, that is $1,750 in profit extra a month. This ignores those customers coming back as regulars – which is more profit.

Remember, if these customers aren’t finding your Restaurant, they are finding your competitors.

Get one of our obligation free 7 point website SEO audits to see what you can get your web developer to fix to increase your revenue today.