Is Deliveroo leaving Australia? That is our prediction for 2020. Based on restaurant feedback, increased competition and the initial success that DoorDash has had in Melbourne, we believe that Deliveroo Head Office will shutter the Australian operations.

2020 may prove to be the perfect storm for Deliveroo leaving Australia.

Why we think there is a good chance of Deliveroo leaving Australia:

- Long time CEO Levi Aron left in July.

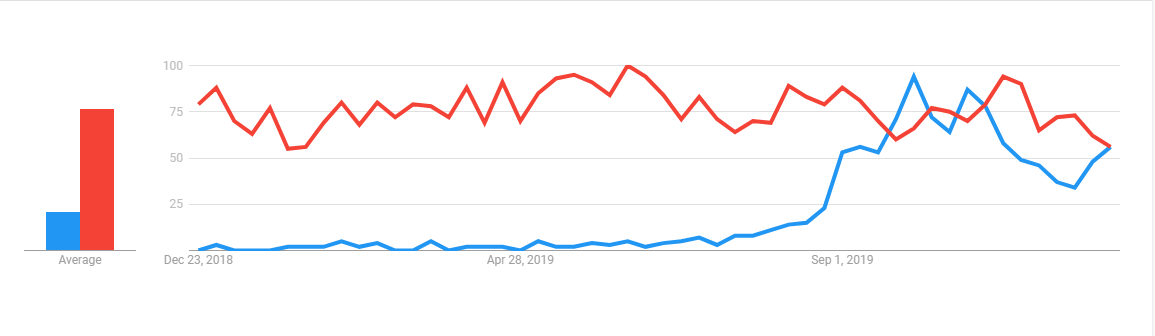

- DoorDash has been generating more interest in key market Melbourne. This is set to expand next year.

- Delvieroo has already closed it’s business in Germany this year.

- Growing consumer resentment against delivery aggregators.

- Growing legal risks around the status of employees.

- Growing alternatives for Restaurants, including free online ordering systems, as they struggle for profitability.

- Ongoing consolidation in the market, with UberEats looking to leave India.

We believe that these factors suggest that DoorDash will have the deeper pockets out of the 2 companies and will force Deliveroo head office’s hand to close the struggling Australian business. Talking to Restaurants, we definitely get the feeling that the flow of orders is weaker for many with Deliveroo than UberEats. The question then will be what the future for Menulog in Australia and New Zealand holds. Will DoorDash overtake struggling Menulog and is the market big enough for 2 delivery aggregators.

UberEats leaving India.

There is ongoing consolidation in the Restaurant Delivery market following talks of UberEats selling it’s Indian operations to Zomato and Deliveroo closing it’s German operations in August. Zomato CEO Deepinder Goyal has spoken about the need to be number 1 in a market, otherwise the economics of building the 3 sided market doesn’t benefit from the network effect and it will never be profitable.

Is DoorDash competition setting the conditions for Deliveroo to leave Australia?

We were shocked to see the entry of DoorDash into the Australian market. Australia is too small of a market for 3 and possible 2 competitors, so the additional of DoorDash to Menulog, Deliveroo and UberEats dramatically increases the financial pressure on the 3 incumbent companies as they look to move towards profitability.

They have been aggressive in the Australian market, signing up Restaurants without their permission.

This comes after Deliveroo’s long term CEO, Levi Aron left the company in July. Aron is a talented CEO with skills in scaling up companies in Australia, and his leaving was probably quite a blow to Deliveroo.

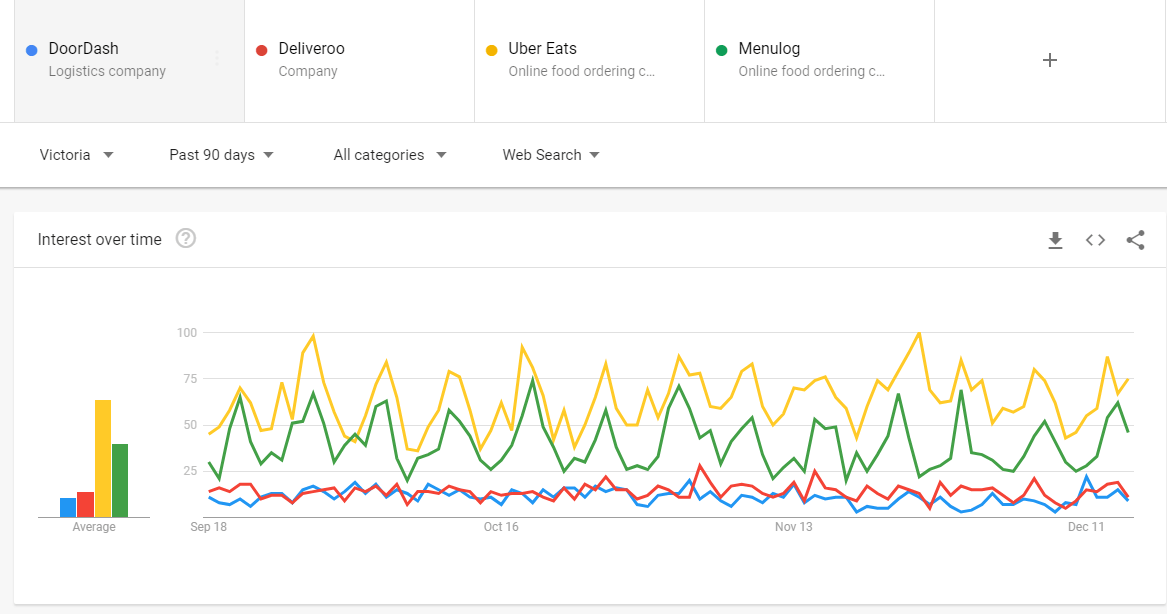

This graph shows Google Search Trend data for Victoria over the last 90 days and it clearly shows a DoorDash sometimes receiving more searches than Deliveroo. Obviously some of these searches will be diners and Restaurants wanting to find out who this new player is, but it also highlights how far behind Deliveroo is compared to UberEats and Menulog. We believe that DoorDash, potentially with deeper pockets will be able to outspend Deliveroo, sign up more Restaurants, get more delivery riders and have more transactions than Deliveroo. This places Deliveroo 4th in a 2 horse race.

Ongoing issues for Delivery Aggregators

We expect 2020 to be very challenging for online Restaurant delivery aggregators for a number of reasons.

- Competition. Australia is clearly not big enough for 4 companies. We expect Deliveroo and either Menulog or DoorDash to close later in the year or in 2021. It depends on the depth of DoorDash’s pockets.

- Alternatives. More Restuarants are moving to pick up only or running their own Free Restaurant OnLine Ordering systems or their own POS system as they fight against what for many Restaurants is unsustainable fees and charges. These free Restaurant tools are freeing up saving Restaurants money and building Restaurant customer lists that are increasing profitability for Restaurants.

- Legal Risk. We expect ongoing legal cases where riders fight for employee status and Governments try to come to terms with the full time and part time jobs that are cannabalised by Gig economy workers.

- Lack of profitability. Menulog’s parent company (Just Eat) shareholders have called for a divestment of Menulog in Australia due to it’s lack of profitability. We suspect that the Australian market may only be big enough for 1 company. Whether the ACCC would allow this is another matter, with potentially a duopoly with a weak second player forming.

- Decreasing consumer sentiment. More customers are becoming disenchanted with the model, realising the pressure it places on small businesses, health concerns given that 1/3 of delivery riders admit to ‘sampling’ food.

- Restaurant churn. There is little doubt in our minds that most restaurants experience a decrease in profitability with delivery aggregators. This creates a situation where many Restaurants either close or stop using the services. This puts up the cost to acquire a customer as churn requires continually finding of new customers.

- Rider churn. It is difficult to find long term riders with any of the companies. It appears that many are back packers or migrants and it is unclear how much tax they are remitting to the Government. Churn means that they are continually trying to find new riders, increasing the costs to replacing riders leaving the company.

- Restaurant Profitability. Many Restaurants struggle to be profitable given the commission charges

Long Term Profitability for Restaurant Delivery Aggregators?

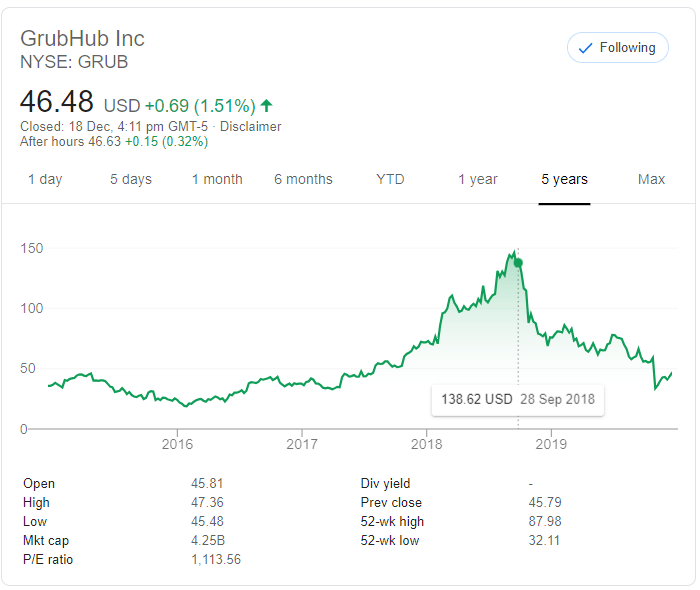

The recent share price collapse of GrubHub highlights the lack of profitability in the industry and raises questions over Just Eat, Menulog, Deliveroo and UberEats.

Ubers Q3 results released in November showed a 73% increase in orders to $3.6 billion but revenue grew slower at 64% to 645 million, and the EBITDA loss grew at 67% to $316 milllion. That is a lot of money to lose and doesn’t include platform R+D. The entire Uber Group lost $1.1 billion for the quarter. That is a lot of money to burn through, especially as they are trying to get EBITDA positive by 2021. With plenty of cash in the bank, Uber can afford to wait out it’s less well capitalised competitors. UberEats has commenced talks to sell their Indian operations to Zomato. This could be a part of a move to stem the loses in the UberEats part of the business and could signal further regional divestments.

The GrubHub share price has collapsed over the last 12 months as it struggles to create a profitable business model.

What Should Restaurants do?

- Think about whether you need online order. If your kitchen is at capacity on Friday and Saturday, when most of the online orders are, you may not need online order.

- Do some menu engineering to understand the profit dynamics of delivery. 35% commission can destroy profitability quicker than anything.

- Think about take out only. Free Restaurant OnLine Ordering systems make this an easy way to increase profitability and gain customer contact details.

- Put your prices up on delivery platforms, driving customers to pick up or order direct.

- Run a loyalty campaign. Moving your customer to the right on the customer loyalty graph increases profitability and the value of your Restaurant.

Not every Restaurant should do online ordering and no Restaurant should do online ordering at a loss.

Is Poor SEO Killing Your Restaurant?

Too many times we see customers with websites that are costing restaurants thousands of dollars every month through poor design, poor messaging and poor SEO. If your website could be improved to bring in 200 extra visits per month and just 10% of those made a booking, and each booking was for 2.5 seats on average at $50 a seat, you would have an extra $2,500 in revenue a month. A 30% food cost, that is $1,750 in profit extra a month. This ignores those customers coming back as regulars – which is more profit.

Remember, if these customers aren’t finding your Restaurant, they are finding your competitors.

Get one of our obligation free 7 point website SEO audits to see what you can get your web developer to fix to increase your revenue today.